Essential Forex Trading Training: Unlock Your Trading Potential

Investing in the foreign exchange (forex) market can be both profitable and overwhelming for beginners. To achieve success, it’s essential to seek quality education and training. This article covers fundamental aspects of forex trading training, effective strategies, and the importance of choosing the right broker, such as forex trading training Brokers Argentina, for your trading journey.

Understanding Forex Trading

The forex market is the largest and most liquid financial market globally, with a daily trading volume exceeding $6 trillion. Unlike stock trading, the forex market operates 24 hours a day, five days a week. This unique feature provides traders with flexibility in choosing when to trade, but it also requires a strong understanding of market dynamics and trading strategies.

The Importance of Forex Trading Training

Learning the fundamentals of forex trading is crucial to achieving success. Forex trading training often includes a range of topics, including:

- Basic concepts of forex trading

- The mechanics of forex trading

- Technical and fundamental analysis

- Chart patterns and trading indicators

- Risk management and psychology of trading

Basic Concepts of Forex Trading

Forex trading involves buying one currency while simultaneously selling another. Traders utilize currency pairs, such as EUR/USD or GBP/JPY, to speculate on the direction of exchange rates. Understanding how to read quotes, pips, and spreads is essential for any aspiring trader.

The Mechanics of Forex Trading

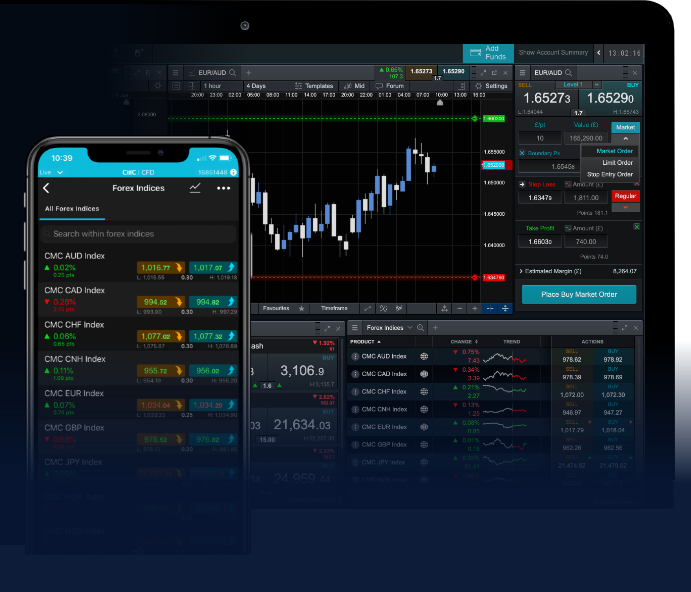

To effectively engage in forex trading, you must familiarize yourself with trading platforms and order types. Platforms allow you to execute trades, manage your account, and analyze market data. Common order types include:

- Market Orders

- Limit Orders

- Stop Orders

Fundamental and Technical Analysis

Forex traders rely on both fundamental and technical analysis to make informed decisions. Fundamental analysis involves evaluating economic indicators, news events, and geopolitical factors that impact currency values. In contrast, technical analysis focuses on historical price movements and chart patterns to predict future price behavior. Effective traders combine both methods to enhance their trading strategies.

Technical Analysis: Chart Patterns and Indicators

Understanding chart patterns is essential for successful technical analysis. Traders often use patterns like head and shoulders, flags, and triangles to identify potential reversals or continuations. Additionally, trading indicators such as moving averages, Relative Strength Index (RSI), and MACD can provide further insights into market trends and help traders make better decisions.

Developing a Trading Strategy

A well-defined trading strategy is key to achieving long-term success in forex trading. Traders should consider factors such as risk tolerance, time commitment, and market knowledge when developing their strategies. Strategies can range from day trading, which involves opening and closing trades within the same day, to swing trading, which involves holding positions for several days or weeks.

Risk Management in Forex Trading

Risk management is one of the most critical aspects of forex trading. Successful traders know how to protect their capital and minimize losses. Some effective risk management techniques include:

- Using stop-loss and take-profit orders

- Determining position sizes based on account balance

- Diversifying trading strategies

- Avoiding over-leveraging

The Mindset of a Successful Trader

Psychology plays a significant role in trading success. Traders often face emotional challenges, including fear and greed, that can lead to impulsive decisions. Developing a disciplined mindset and maintaining a trading journal can help traders analyze their performance and improve their emotional control.

Choosing the Right Forex Broker

The choice of a forex broker can significantly impact your trading experience. It’s essential to select a broker that aligns with your trading goals and preferences. Factors to consider when choosing a broker include:

- Regulation and reputation

- Trading fees and spreads

- Available trading instruments

- Customer support and platform usability

Conclusion

Forex trading training is crucial for anyone looking to enter the forex market. By understanding the basics, mastering trading strategies, and implementing effective risk management techniques, you can unlock your trading potential. Remember that continuous education and practice are essential for long-term success. Whether you’re a beginner or an experienced trader, investing time in your trading education will pay off in the long run. Embrace the journey, choose the right tools, and stay committed to your trading development.